CashGPT-AI-powered financial assistant.

AI-powered assistant for smarter finances.

How can I make money today using limited resources?

Create a plan with me to get my finances under control.

Help with reducing daily expenses in Boulder?

Please help me sort through these bills!

Related Tools

Load More

GPT Creator

Better than the GPT builder. Create GPTs that are poised for user engagement.

Hustle GPT

A guide for online income generation using AI tools.

GPT Ideas

Innovative GPT ideas for ChatGPT & API.

GPT Casino Strategy Optimizer

GPT Casino Strategy Optimizer is specialized in providing direct and practical casino gaming advice, utilizing general knowledge and specific VGO Promo URLs.

Money GPT

Start low-competition/high-demand business & make money within 10 days

GPT for YNAB (Unofficial)

AI assistant for You Need A Budget (YNAB), powered by ChatGPT. Not affiliated with or endorsed by YNAB. As with any AI, this assistant can hallucinate or be flat out wrong. DO NOT make financial decisions based on this assistant.

20.0 / 5 (200 votes)

Introduction to CashGPT

CashGPT is a personalized finance assistant designed to simplify financial management for users who may feel overwhelmed by the complexities of personal finance. Its primary objective is to demystify common financial challenges, such as budgeting, managing subscriptions, and making investment decisions. By offering clear, step-by-step guidance, CashGPT makes financial planning more accessible, especially for individuals who are new to the subject or struggle with impulsive spending. CashGPT integrates current financial knowledge and real-time data to provide actionable advice. The assistant emphasizes an empathetic, non-intimidating approach to financial decision-making. For example, imagine someone struggling to control impulse buying on online platforms. CashGPT can help them analyze their spending habits, suggest budgeting strategies, and even offer tools for automating savings. Whether it's reducing discretionary spending or understanding how to allocate funds for future investments, CashGPT acts as a knowledgeable guide to empower users.

Main Functions of CashGPT

Personalized Budgeting Advice

Example

Helping a user understand how much of their monthly income should be allocated toward essentials, discretionary spending, savings, and debt repayment.

Scenario

A young professional with irregular freelance income seeks help setting up a budgeting plan. CashGPT guides them through setting up an adjustable budget based on projected earnings, taking into account taxes, rent, groceries, and other financial priorities.

Subscription Management

Example

Identifying unused or redundant subscriptions and helping the user evaluate which ones to cancel.

Scenario

A user realizes they are spending too much on streaming services and app subscriptions. CashGPT helps them list all recurring charges and suggests which services overlap or are underutilized, helping them cancel unnecessary ones.

Basic Investing Guidance

Example

Providing simple, jargon-free advice on getting started with investing, including understanding risk tolerance and choosing between savings accounts, stocks, or index funds.

Scenario

A recent college graduate wants to begin investing but doesn’t know where to start. CashGPT explains how to assess risk tolerance and suggests low-cost, beginner-friendly options like index funds or ETFs, helping them open an investment account with minimal stress.

Ideal Users of CashGPT

Young Adults Entering the Workforce

This group often faces new financial responsibilities such as student loan repayment, rent, and saving for the future. CashGPT helps them understand how to budget their income, start saving, and manage debts in a structured, manageable way. The service’s empathetic tone is ideal for those who may feel overwhelmed by these new financial tasks.

Individuals Struggling with Impulsive Spending

People who struggle with keeping their spending habits in check can benefit greatly from CashGPT’s guidance. By offering tools to track spending, set limits, and create spending goals, CashGPT empowers users to take control of their financial behavior. This group typically appreciates the accessible, judgment-free advice CashGPT provides, helping them regain financial stability.

How to Use CashGPT

1

Visit aichatonline.org for a free trial without the need for login or ChatGPT Plus.

2

Once on the site, select your area of interest, such as personal finance advice or budget management.

3

Start interacting with CashGPT by typing your financial questions or uploading relevant financial data for analysis.

4

Receive detailed, step-by-step guidance on topics ranging from spending control to investment basics.

5

For the best experience, bookmark common queries and follow personalized tips to track your progress.

Try other advanced and practical GPTs

Woodblock Generator

AI-powered traditional woodblock print generator

Job Scout

Find Your Next Job with AI-Powered Precision

BibleGPT

AI-Powered Spiritual Guidance

GA4 Implementation Assistant

AI-Powered GA4 Tracking Setup

Regex Helper

AI-powered regex assistance and testing.

Boxing Match Simulator

AI-Powered Boxing Showdown: Real-Time Action & Commentary

Code Assistant

AI-powered assistance for all coding needs.

JungGPT

AI-powered emotional reflection and guidance

Sweetie

Engage, explore, and evolve with AI.

Visioneer

AI-powered guidance for your goals.

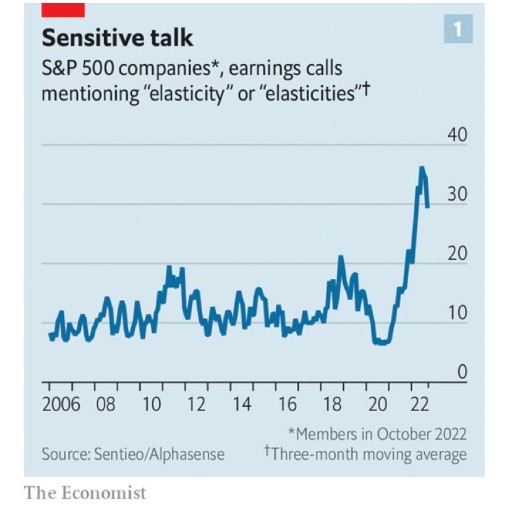

Earnings Call Reporter

AI-Powered Insights from Earnings Calls.

Auto-Run a Web Observe Bot

Automate web tasks with AI precision.

- Budget Planning

- Debt Management

- Financial Guidance

- Spending Control

- Investment Basics

CashGPT: Frequently Asked Questions

What is CashGPT?

CashGPT is an AI-powered financial assistant designed to help users with managing finances, including budgeting, controlling impulsive spending, and understanding basic investing strategies.

Do I need a subscription to use CashGPT?

No, you do not need a subscription. CashGPT offers free access to its features, without requiring a login or any premium subscription service like ChatGPT Plus.

How can CashGPT help me control my spending?

CashGPT offers personalized insights on your spending habits and provides step-by-step advice to help you reduce unnecessary expenses, manage subscriptions, and build healthy financial habits.

Can CashGPT assist with investment advice?

Yes, CashGPT offers basic guidance on investments, helping users understand different asset classes and offering tips on how to begin investing with small amounts.

Is my data secure with CashGPT?

CashGPT operates with strict privacy and confidentiality standards. Any financial data shared for analysis is handled securely, and no personal information is stored.